read time • 6 mins

A Cruel Summer: The Intersection of Taylor Swift and American Railroads

It’s August 2025. It’s hot out. And, if you’re like us, there’s no way you can hear the Taylor Swift classic, “Cruel Summer”, without ruefully thinking about the current state of the North American freight market. Freight carriers are enduring their third year of “freight recession”, and there appears to be no respite on the horizon. Sluggish manufacturer, small business, and consumer sentiments are all weighing heavily on demand for transportation services. At the same time, ongoing and escalating tension in the Middle East and trade wars are inching overall uncertainty (and potentially input prices) higher and higher. In some ways, it’s just like Taylor belts out in “Cruel Summer”, “…Ain’t that the worst thing you ever heard!?”

Opportunity in Cruelty

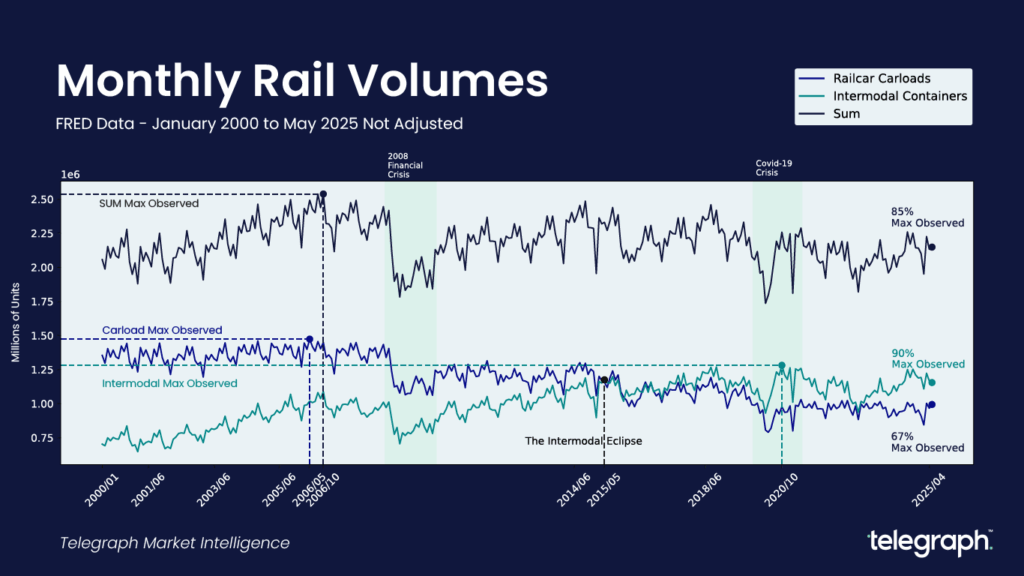

What does freight’s “Cruel Summer 2025″ mean for railroad shippers? At Telegraph, our prognosis is actually not all bad news. We think the Summer of 2025 may prove to be an opportune time for both railroads and rail-curious customers. How can that possibly be, you might ask. First, one has to understand a simplified anatomy of freight rail. On freight railroads, there are two basic lines of business: “carload” and “intermodal”. “Carload” refers to what your imagination might conjure when you think of railroads – Thomas-the-train-style rail cars full of coal and grain and other bulk items. “Intermodal” refers to shipping containers – the ubiquitous boxes you see atop cargo ships, trains, and 18-wheelers. The chart below shows monthly volumes for each of these two lines of business – carload and intermodal – from 2000 to May 2025.

Two things about the above chart suggest some opportunity amongst all this Summer’s freight cruelty. The first thing we can observe is that the intermodal business is operating at 90 percent of the 20-year observed highs – and has been for some time! If you consider 20-year observed highs as a proxy measure for intermodal network capacity, well then that’s high! General operations management theory suggests that any supply-constrained system operating at over 80% of its throughput capacity will experience inventory build up and processing delay at its bottleneck point. This is in fact precisely what rail shippers have been suffering when rail car congestion builds up at North American intermodal hubs and junctions. At Telegraph, we report regularly on congestion experiences for our customers and update our proprietary rail shipment estimated time of arrival predictions to accommodate these chronic congestion delays. Cetrius paribus then, in 2025, slowing down our country’s typical Q3 and Q4 containerized import surge might actually bring some welcome respite to an American intermodal network that is already stretching thin in some places to keep up with demand. The implication for savvy shippers is that this cruel freight summer could actually surface unique opportunities for faster service at lower prices in the second half of 2025.

But what about long-falling carload volumes? Carload volumes represent only 67% of 20-year highs – and continue to drop. Why? One reason is the fizzling of the once hot relationship between American power generation and American coal production. Coal is a commodity perfectly suited to carload rail transportation. But over the last 20 years, American electricity generators have fallen out of love with coal in favor of greener alternatives. After all, you can’t put sunshine, or wind in a railcar.

On the 4th of July this year – while many of us were kicking off the Summer of 2025 with hot dogs and fireworks – US President Donald Trump declared “Coal is back” in comments he made from the Oval Office while signing his “Big Beautiful Bill”. Among other things, the Big Beautiful Bill also cuts incentive programs for alternative energy sources like solar and wind power. So how will American electricity be generated going forward? If coal really is back, it’s a potential boon to carload volumes, and will come as especially welcome news to both the railroads and the rail car lessors who specialize in carload rail freight. This development should figure into both carriers’ and railcar lessor’s resource deployment plans over the next 24 months.

Other political developments may also support near-term carload volumes too. Consider ethanol. Typically, over 90 percent of US ethanol moves via railroad tanker cars. If it holds, the administration’s recent agreements with the EU to open up that market for the first time for American ethanol exports is likely to result in higher volumes of American ethanol moving from the heartland and to the shipping docks on railcars.

The truth is, of course, that anything can happen – and often does. To once again quote Ms. Swift’s “Cruel Summer”, “Devils roll the dice; angels roll their eyes.” How will we know if all this opportunity in cruelty is actually transpiring? First, we’ll look to the seaports. With our customers, we’ll be watching inbound container volumes at major American container ports like Los Angeles/Long Beach, Savannah, and the Port Authority of New York/New Jersey. Whether or not the intermodal system is truly slowing down this summer will be evident there first. American port data will also offer early indication of any potential uptick in ethanol exportation owing to newly opened European markets. However, in this case, we’ll be looking at the data from a different seaport, the Port of Houston, given it is the facility for handling liquid tanker cargo and existing logistical connections to the American midwest, where ethanol plants are congregated. The changes to America’s electrical fuel mix that we’ve forecasted will be slower burning, and therefore unlikely to show up in any near-term monthly reporting. However, one could interpret all the pending trade press obituaries for ambitious Inflation Reduction Act-supported power projects as mile markers counting up toward that fateful destination.

If what Ms. Swift sings is indeed true, then at Telegraph, we’re somewhere in between the two, squinting deep into the data, trying to help you, the casual reader – and our customers – to leverage our cutting edge rail data, top-notch software engineering and data science teams, and state-of-the-art technology stack to see around the freight market’s corners, and to identify all its rail-borne opportunities – even when those opportunities are obscured in cruelty. Interested in learning more about how we can help you navigate rail through this cruel summer and beyond?

Schedule a demo with our team today!

About the Author

David Correll is the Director of Freight Market Intelligence at Telegraph. He has spent two decades in transportation and logistics with the US Department of Transportation, the US Department of Energy, the Massachusetts Institute of Technology, and Clark University. David brings his many experiences – and a little bit of wit – to help us break down some of the more nuanced challenges and opportunities facing American rail transportation.