read time • 10 mins

From Golden Spike to Mega-Mergers: The Evolution of North American Freight Rail

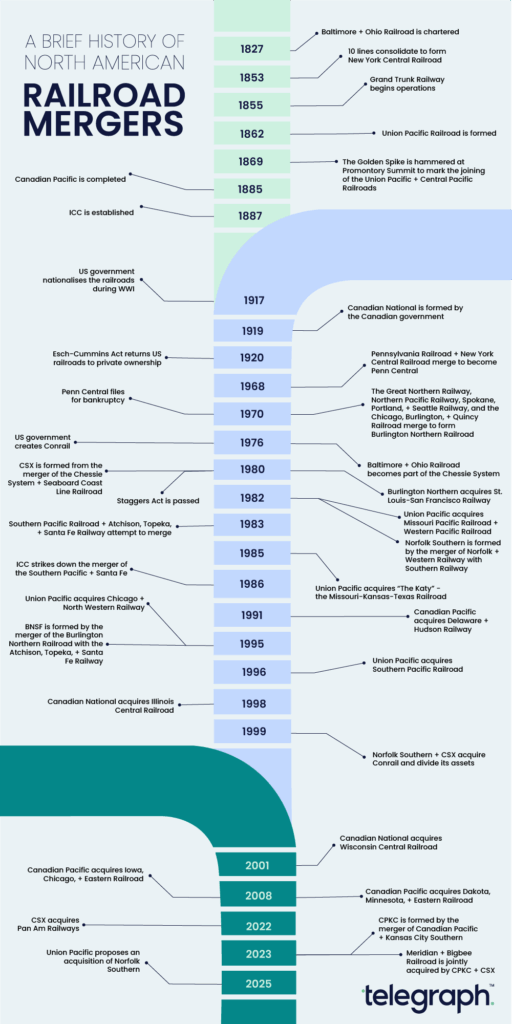

From the 1800s onward – truly from the onset of railroading in North America – railroads have been forming, merging, splitting, and then merging all over again. Each time, the rails and economic landscape of North America are reshaped in the process. With Union Pacific and Norfolk Southern currently attempting to fashion themselves into the first modern transcontinental railroad, there is no better time to revisit the tracks that got us here in the first place.

Humble Origin Story

In the early 19th century, railroads were just beginning to emerge in the United States. The Baltimore & Ohio, chartered in 1827, was the first major US railroad, and its inception symbolized the dawn of a new era in North American transportation. However, this small, regional rail line would not stand alone for long. The United States, in the throes of the Industrial Revolution, wanted more: more reach, more connections, more markets, more money. Less than 30 years later, by 1853, enough railroads had emerged that the New York Central had already consolidated 10 smaller lines into one major railroad stretching across upstate New York. The New York Central, in what could be dubbed its Vanderbilt Era, continued acquiring lines along the Hudson Valley and Great Lakes regions throughout the 1860s and 1870s. In 1869, the first transcontinental railroad was completed when the Union Pacific Railroad was joined with the Central Pacific Railroad at Promontory Summit, Utah. Canada made similar moves, with the Grand Trunk Railway beginning their operation in 1855, and eventually gobbling up multiple smaller rail lines to expand across the provinces and, eventually, into the US.

These ventures were a lot more than just transportation projects. They were the embodiment of the American spirit, and the steadfast ambition of a few notable men. Cornelius Vanderbilt, Andrew Carnegie, Jay Gould, and other “rail barons” realized that rail consolidation meant not just greater efficiency, but also greater power. Owning the railroads meant owning the routes for coal, timber, steel, grain, and, especially at the time, people. Owning these things meant that these rail barons were truly the ones pulling the levers on the US economy. Because of this, the speed at which mergers – and even new rail lines – appeared only became faster.

When Government Got Nervous

By the end of the 19th century, railroads had truly become monopolies. Rates were easily manipulated, rivals could be crushed seemingly overnight, and shippers were left at the mercy of whoever was the prevailing line. Because of this, regulatory responses were enacted that still shape the industry to this day. In 1887, the Interstate Commerce Commission (ICC) was established. This was the first federal regulatory commission in US history, created almost entirely because of railroad excess.

The early part of the 20th century was fraught with tension on a global scale. During World War I, the US government nationalised the railroads. After entering the war, the US needed to ensure that troops, equipment, and supplies essential to the war effort were being efficiently transported. Needless to say, the private owners were less than thrilled by, what they perceived as, a takeover that diminished their profits and potentially led to political interference in the railroads.

Fortunately, after World War I, the US Congress passed the Esch–Cummins Act of 1920, which returned the ownership of the railroads into the hands of the private owners. It also encouraged mergers, but only with the blessing of the ICC. In theory, this would create stronger systems without the destructive chaos of unfettered competition. In practice, it laid the groundwork for decades of consolidation.

Penn Central, or The Rail Merger of Epically Bad Proportions

No history of rail mergers is complete without talking about Penn Central. In 1968, the Pennsylvania Railroad and New York Central – two industry giants and the fiercest of rivals – decided that their ultimate survival hinged on combining their forces. On paper, it was a juggernaut: 20,000 miles of track, 100,000 employees, and coverage across the Northeast and Midwest. In reality, it was a disaster.

The cultures clashed, the technologies did not mesh, management failed to properly merge the systems, and, to top it all off, seemingly no forethought was given to the consolidation of equipment, meaning the newly formed railroad was left with an abundance of outdated equipment. Within two years, Penn Central filed the largest bankruptcy in US corporate history, at the time. The collapse was so severe it forced the federal government to create Conrail in 1976, a state-sponsored rescue effort that eventually became profitable after the 1980 Staggers Act deregulated the industry. Penn Central ultimately became a huge name – not for their success, but for the idea that mergers can really make you big, or they can really make you broke.

Deregulation and the Merger Boom

The real turning point for merger came with the Staggers Rail Act of 1980. By deregulating freight rates and giving railroads freedom to abandon unprofitable lines, Congress effectively put the industry back in private control. The result was a wave of mergers that built the modern map.

Union Pacific snapped up Missouri Pacific and Western Pacific in 1982, then kept going until it added “The Katy”, or Missouri-Kansas-Texas Railroad, in 1985, then Chicago & North Western in 1995, and finally Southern Pacific in 1996. Norfolk Southern, born from the merger of Norfolk & Western and Southern Railway in 1982. CSX was formed by the merging of the Chessie System – which for its part was a patchwork of eastern rail lines, such as the country’s very first railroad, The Baltimore & Ohio – and Seaboard Coast Line – which was composed of many other lines, like the Atlantic Coast Line. Eventually, in 1999, Norfolk Southern and CSX acquired Conrail in a 58/42 split. Burlington Northern merged with the Atchison, Topeka & Santa Fe in 1995 to create BNSF, completing the set of today’s “Big Four” US railroads: Union Pacific, BNSF, Norfolk Southern, and CSX.

These mergers were definitely about survival of the fittest railroads, but they were also about creating more efficiency in rail service. By the mid-1990s, North America had consolidated down from dozens of Class I railroads to just seven. Costs dropped, productivity soared, and Wall Street cheered. For shippers, the picture was mixed: streamlined networks often meant better long-haul service but also fewer competitive options.

The Merger That Wasn’t: Southern Pacific and Santa Fe

One of the saddest stories of the merger era was the attempted union of the Atchison, Topeka, & Santa Fe and Southern Pacific in the mid 80s. In 1983, they created a holding company, repainted locomotives, and even completely rebranded as the Southern Pacific Santa Fe Railroad (SPSF). Three years later, in 1986, the ICC put the kibosh on the deal, citing competitive overlap. Before there were memes, there were railfans joking about the bright red-and-yellow “Kodachrome” locomotives left stranded with “SPSF” on the side, or, as it became known – “Shouldn’t Paint So Fast.” Within the decade, Santa Fe ended up with Burlington Northern, while Southern Pacific found its way into Union Pacific.

North of the Border

Canada’s rail story mirrors the US, but with a twist. The Canadian Pacific Railway (CP), completed in 1885, was the original transcontinental line and remained fiercely independent. The Canadian National Railway (CN), by contrast, was formed by the government in 1919, absorbing bankrupt private railroads like the Grand Trunk.

For decades, CN and CP were Canada’s duopoly. But in the 1990s and 2000s, CN expanded aggressively into the US, acquiring Illinois Central in 1998 and Wisconsin Central in 2001, giving it a north-south corridor deep into the Midwest. CP followed with its own acquisitions, including the Dakota, Minnesota, & Eastern, and Iowa, Chicago, & Eastern in 2008. Most notably, however, was their merger with the Kansas City Southern in 2023, creating CPKC – the first truly North America–spanning railroad linking Canada, the US, and Mexico. This deal raised the stakes for US carriers and set the stage for today’s mega-merger talks.

Enter the Modern Mega-Merger

All of this has led us to where we have found ourselves in recent weeks – a not surprising, yet still remarkable headline: Union Pacific’s proposed $85 billion acquisition of Norfolk Southern. If approved, it would be the largest railroad merger in US history and the first modern coast-to-coast freight network. Union Pacific’s strong western coverage and Norfolk Southern’s eastern dominance would knit together into a 50,000-mile colossus spanning 43 states.

The pitch is simple: more efficiency, faster coast-to-coast service, and $2.75 billion in projected annual synergies – a projected $1 billion in cost savings and another $1.75 billion in revenue growth. Shareholders get a hefty premium, and the company promises new investment, job preservation, and smoother supply chains. It is the transcontinental dream, finally realized – over 150 years after the golden spike was hammered in at Promontory Summit.

However, critics see storm clouds on the horizon. Senate Majority Leader Chuck Schumer called it a “hostile takeover of America’s infrastructure,” warning that cutting four major US freight railroads down to three could hurt competition, raise shipping costs, and degrade service. Labor unions have expressed skepticism too, pointing out that past mergers often meant job cuts, safety concerns, and operational chaos.

Ultimately, we have to look to the Surface Transportation Board (STB). This five-member body holds the keys to the kingdom, if you will. We should expect that their review process will be long, thorough, and possibly contentious, with hearings stretching over many months. The STB estimates that a final decision would take 22 months, well into 2027. Many do not see this deal being rubber stamped, particularly given the STB’s legal requirement to ensure that mergers enhance industry competition.

Why This Merger Matters

On one hand, railroads are a natural monopoly, and consolidation has historically improved efficiency. On the other hand, too much consolidation risks reducing the competitive pressure that keeps service strong and prices fair. Shippers, regulators, labor unions, and politicians are all lining up for what could be the railroad fight of the decade.

The UP–NS deal also raises the question of dominoes. If it goes through, will CSX look for a partner? Will BNSF, owned by Warren Buffett’s Berkshire Hathaway, make a countermove? Analysts are already buzzing about whether this is the beginning of another wave of megamergers.

The Legacy of Mergers

From the early days of Vanderbilt to the Penn Central fiasco, from the birth of Conrail to the many mergers that led to the Class I railroads of today, every merger has left its mark – some creating stronger, more efficient systems, others imploding under their own weight.

Now the stakes are higher than ever. A coast-to-coast network could change freight rail in ways not seen since the 19th century. Whether it delivers the promised efficiencies, or becomes another Penn Central depends on how well history’s lessons are heeded. Hopefully, the two companies will find it within themselves to hold off on painting any locomotives with the eponymous UPNS.

Final Stop

The story of rail mergers in North America is an epic story of ambition, regulation, collapse, revival, and reinvention, of companies that dreamed too big and others who didn’t dream quite big enough. Ironically, or perhaps not so much, Union Pacific was at the center of the very first transcontinental railroad, and finds itself once again making waves as the potential front runner for a modern version. As Union Pacific and Norfolk Southern make their case for building the ultimate railroading giant, it is impossible to ignore the lessons learned from past mergers, and hope that those lessons will be remembered. Going forward, the only question is whether this next chapter in the book of rail mergers will end in triumph or defeat.

Want more merger talk? Check out our Talk Track episode where we discuss the UP-NS merger in depth!